Maintaining regulatory compliance for payroll and HR data is a critical responsibility for all organizations. Key aspects include understanding data retention requirements, implementing robust security measures, and staying informed about evolving regulations.

Federal, state, and international laws mandate specific retention periods for various types of employee data. For instance, the FLSA requires certain payroll records to be kept for at least three years, while some states extend this to seven years. Implementing strong security and smart data compliance can help you protect data and manage regular audits.

Many regulations require regular reporting to authorities. Ensure your systems can generate accurate and timely reports for tax filings, EEO compliance, and other regulatory needs. Be prepared for potential audits by maintaining easily accessible historical data and clear audit trails.

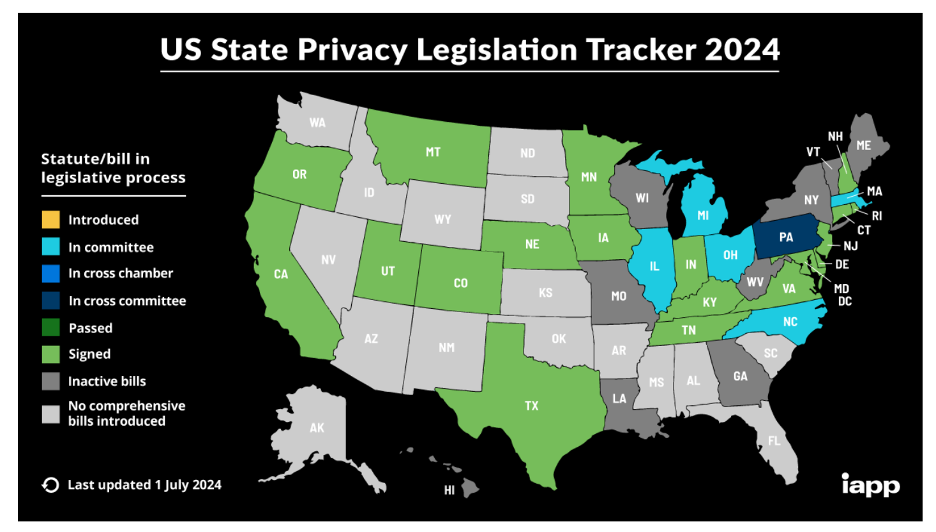

Stay informed about changing regulations, including both federal laws and state-specific requirements. Be aware of data privacy regulations like GDPR or CCPA that may apply to your organization, especially if you have employees in multiple states or countries.

Consider partnering with specialized providers like ResNav to automate data management processes, reduce human error, and ensure consistent compliance.